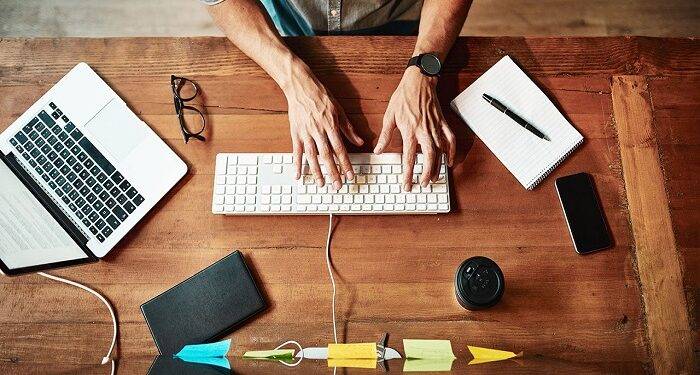

Fintech is currently revolutionizing the lending industry. For many years, obtaining a loan means visiting a nearby bank branch, and sitting down with a loan officer who carefully goes through your financial situation. Now thanks to many fintech loan apps available in India, one can quickly get a loan by entering a few of their details. Fintech doesn’t need a lot of time to grant a personal loan to you. Lenders may access hundreds of data points about borrowers’ financial behaviors and quickly make informed loan decisions using AI, big data, and secure API connections to banking data. This way, getting a personal loan from fintech helps in reducing time and physical barriers. Anybody can download a kreditbee application on their phone; a borrower in a rural area can apply and secure funding in minutes without ever stepping into a bank. Let’s understand the benefits of getting a loan from kreditbee.

- There are several reasons why fintech financing is becoming more and more popular. Fintech firms, for instance, use cutting-edge methods like e-KYC and eSign for digital onboarding, which reduces or eliminates the requirement for paper documentation. Customers can apply for loans to any of the loan apps by submitting their PAN card, Aadhaar card, income statement, and other papers online via an app or website.

- Fintech players use effective underwriting algorithms to quickly authorize loans to genuine borrowers with a history of on-time repayments after analyzing the creditworthiness of customers.

- The loan is typically disbursed by the lender in 7-8 business days. However, thanks to kreditbee or fintech, a borrower can quickly have the money credited to his account

- The majority of banks and financial organizations that offer personal loans offer a minimum sum of Rs. 50,000 and a 12-month minimum term requirement, with a 60-month maximum. However, the maximum amount varies from bank to bank, with the majority of banks citing Rs. 25 lakh as the highest sum. On the other side, fintech loan apps provide personal loans with rates as low as Rs. 20,000 and very flexible terms starting at only three months and going up to 60 months. Fintechs are drawing more borrowers than traditional banks and financial institutions because of their flexible loan terms and loan amounts.

- Employees of privately held firms are also qualified with loan apps. The fact that the applicants work for organizations or businesses not on the list is one of the primary grounds for rejecting personal loan applications. Loans are only provided to the employees of the companies that are listed in the databases of the majority of the country’s main banks. Fintechs, however, are not overly picky about the companies you work for. Fintechs will approve your application if they are satisfied with your credit profile, even though you recently started working for a start-up that is not included in the databases of the major banks.

Things to Remember Before You Avail Loan From a Fintech App

- The EMI is an area to which debtors should pay attention. As a borrower, you should carefully calculate your EMIs to avoid having to make additional payments that drain your funds. Use an EMI calculator to determine the precise amount that must be paid each month and for how long. Always try to keep your EMI payments under 10% of your monthly income. If it is higher, you must carefully plan out your other expenses and make every effort to keep them as low as possible.

- Another area to be careful about is safety and security. For instance, fraud lenders frequently target high-risk debtors who are searching for quick loans. These lenders frequently pressure customers into choosing a loan. Once they take the money, they continually nag them to pay it back by phoning and reminding other family members. Such lenders also don’t divulge their physical addresses, making them impossible to locate. Before requesting a loan, borrowers should carefully review the app or website

- Before applying for a loan, a borrower must first research and understand the reliability of the lender either by visiting the loan apps they are planning to take a loan from or from other channels. For this, they should read through the testimonials, consider both the positive and negative reviews, and determine whether the lender is forthcoming with clients at all stages of the transaction. Speaking with prior loan borrowers and learning about all the benefits and drawbacks is one of the ways to gather truthful feedback about the lender. Having access to these inputs will safeguard borrowers from any risks by enabling them to make educated decisions.

Eligibility Checklist for Instant Loans from Fintechs

The usual eligibility requirements for people looking to get instant loans from fintech are as follows:

Age: To apply for a personal loan from the majority of fintech companies, a candidate must be older than 23. In most cases, the upper age limit is 55. The majority of fintech lenders have income requirements for applicants to be eligible for fast loans. Most businesses expect that borrowers would make a minimum of Rs. 15,000 per month.

Employment: When calculating your eligibility for a kreditbee loan, fintech lenders also take into account your employment history. To be eligible for an instant loan, most businesses require borrowers to have been in their current position for at least two years.

Documents necessary: You will need to provide a few papers when you apply for an immediate loan with a kreditbee or from another fintech company, like your PAN card, Aadhaar card, paystubs or salary statements for the previous three months, bank statements for the last three months, photos, etc.

Credit score: Your credit score is one of the most important elements taken into account by fintech when calculating your eligibility for a quick loan. Most lenders demand that applicants have credit scores of at least 700 to get loans.

Repayment history: In addition to considering your credit score when establishing your eligibility for an instant loan, fintech lenders also take into account your repayment history. It will be relatively simple for you to qualify for a loan with favorable terms if you have a good payback history.

Conclusion

From the aforementioned benefits, one can understand how fintech has changed the entire borrowing process. From submitting an online application to getting a loan disbursed, fintech has made it possible to take a personal loan without using paper in loan queues to reach the counter, and doesn’t have to fill in lengthy application forms. Thanks to the fact that we are living in a digital-first world where all these functions are performed online without the need for physical interactions.